Great Info About How To Avoid The Death Tax

Zimmelman says you can reduce the size of your taxable.

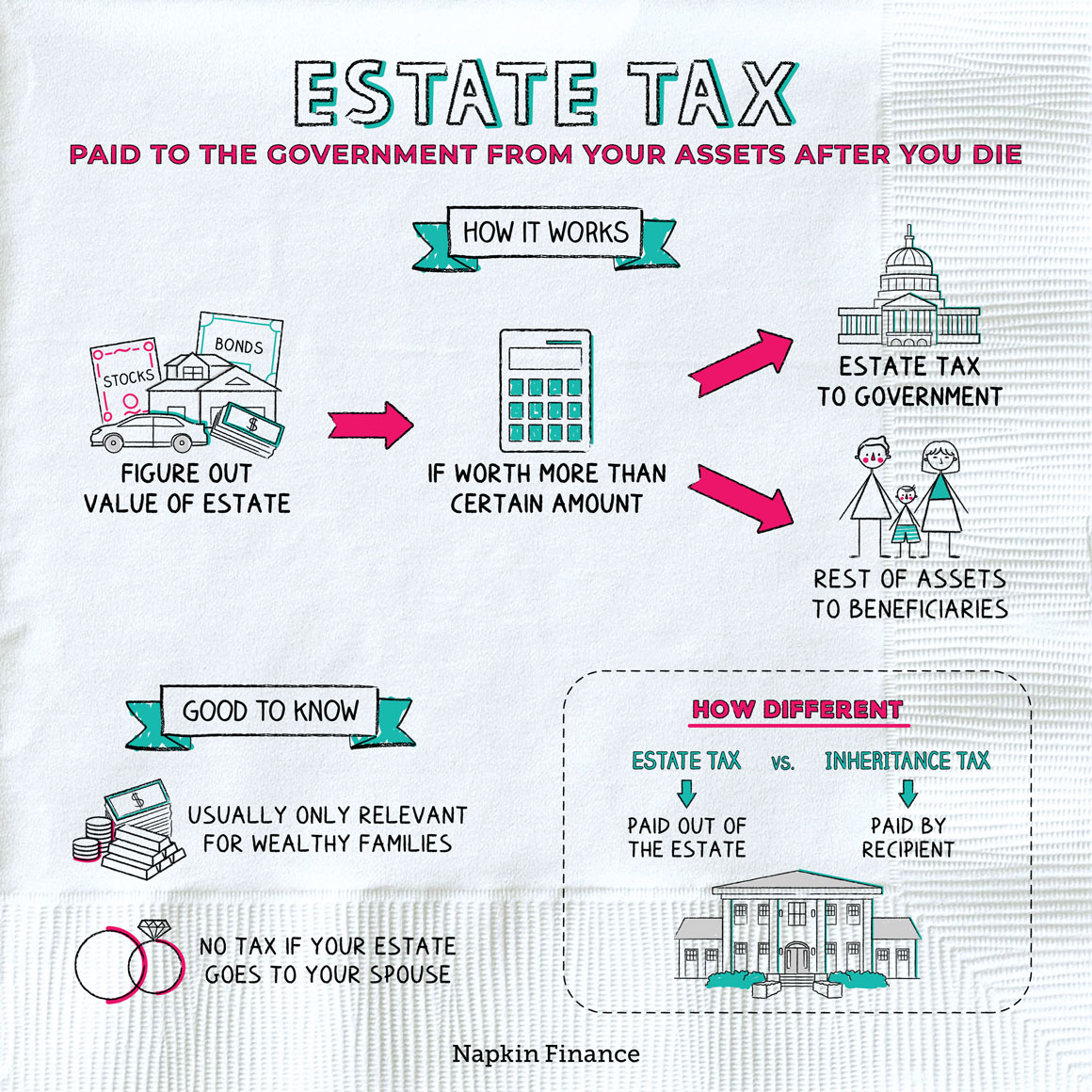

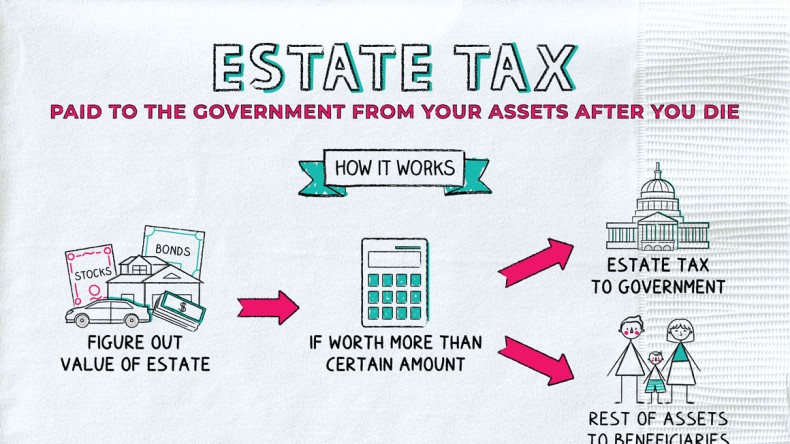

How to avoid the death tax. Depending on state law, probate will generally open 30 to 90 days after the date of death. The best way to avoid the ‘death tax’ on bequeathed superannuation funds is to withdraw the entire balance before you die. That’s because federal tax law allows estates to exclude a certain amount in a tax year up to a certain.

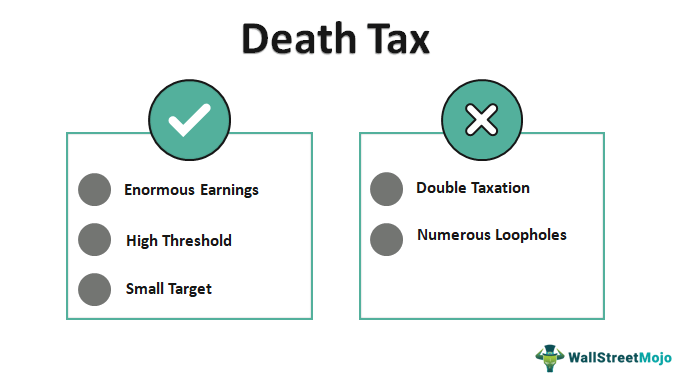

Most of us probably don’t need to worry about the death tax. You can then start giving money or other assets to your children as a way of reducing your taxable estate when you die. Give away some of the money.

If you set up a payable on death life insurance. How do you avoid death taxes? This could result in a lower property value and thus, a smaller tax burden.

In addition to helping those in. An irrevocable trust can be a handy way to avoid estate taxes if your estate is large enough to be potentially liable for them, at both the state and federal levels. There is no federal inheritance tax—that is, a tax on the sum of assets an individual receives from a deceased person.

Gifting is one option to. For example, jake is a parent in florida that. Thus, stay ahead of inflation and not.

A 10% penalty may not sound like much, but combined with taxes, it can significantly cut into your net withdrawal amount. That way, the death benefits won't be taxed as part of the estate. In 2021, the marital deduction is unlimited,.