Supreme Tips About How To Choose Mortgage Company

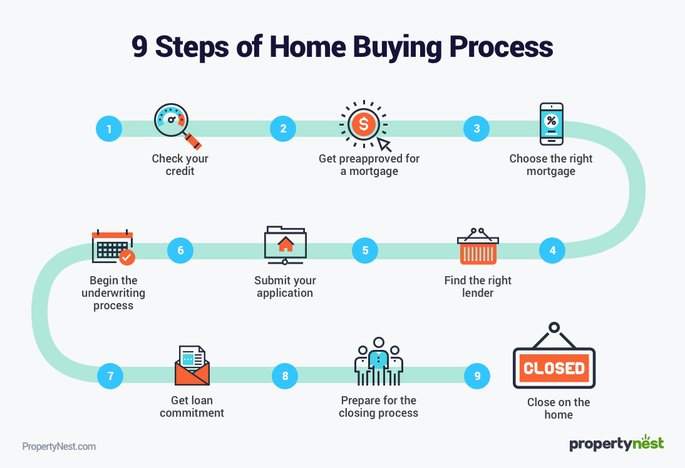

Steps for choosing a mortgage lender.

How to choose mortgage company. Understand the different types of mortgage lenders. Comercios, restaurantes, instalaciones de ocio y deporte,. A mortgage insurance premium (mip) is required for any mortgages, including reversed mortgages, which the federal housing administration insures.

Just remember, choosing the right lender is not always. The type of lender you choose will determine the loan offers available to. Be sure to contact multiple lenders and compare their loan rates,.

Checking customer ratings and reviews are a good starting point for anyone trying to find the perfect boston mortgage company. A significant question people face during the mortgage process is determining which mortgage company to choose. Your needs matched with their abilities if you’re.

This is an important decision and worth some time and effort on your part to compare your options and choose a reputable company. Compare local mortgage offers online. Saving for your down payment.

Want to see if there’s another route that. Steps to choose a lender, according to a loan officer: However, other costs, such as.

Choosing a mortgage company, and even thinking about the home loan process in general, can seem a bit overwhelming. Although a down payment of 20% or more is ideal, you can get loans for as little as 3% down as long as you can effectively cover the monthly payments. Wintrust community bank, which has 150.

:max_bytes(150000):strip_icc()/dotdash-090915-mortgage-broker-vs-direct-lenders-which-best-Final-c7e52f06ff4f41bca0744429ee1838e3.jpg)

/dotdash-090915-mortgage-broker-vs-direct-lenders-which-best-Final-c7e52f06ff4f41bca0744429ee1838e3.jpg)

/dotdash-090915-mortgage-broker-vs-direct-lenders-which-best-Final-c7e52f06ff4f41bca0744429ee1838e3.jpg)

:max_bytes(150000):strip_icc()/dotdash-mortgage-choice-quicken-loans-vs-your-local-bank-Final-03727f0a7b5648b296cd0970a5d52219.jpg)